What Is A Tariff Code?

A tariff code – also known as a commodity code or HS code – is a key element of the shipping process. The code declares which category of goods your freight falls under and therefore the level of customs duty and VAT you will need to pay on your imports.

The code’s ten digits are generated according to their category and possible sub-categories – as detailed on the government’s Trade Tariff site.

[cta url=”https://hemisphere-freight.com/contact/” text=”Need help finding your tariff code? Get in touch!” image=”https://www.hemisphere-freight.com/wp-content/uploads/2020/06/Integrated-Logistics.jpeg“]

Why Do You Need A Commodity Code?

HMRC requires you to declare the nature of your goods when they enter the UK, and the commodity code is a kind of shorthand way to manage this. As the importer, it is your responsibility to ensure your products are carrying the correct codes.

With the correct tariff code on your documents (and any supporting licenses, etc.), your freight will be able to pass smoothly through customs clearance, and you’ll know you are paying the right amount of taxes and duties. If your freight is inspected and found to be incorrectly declared, it could be seized, delayed or destroyed.

When obtaining your tariff code, you’ll also find out:

- if there are any restrictions on your goods;

- if you need an import licence to bring them into the UK;

- whether they will attract anti-dumping duty, or:

- if you might be eligible to apply for a preferential duty rating or duty relief.

The code basically opens the door to a complete picture of the rules around your imports. If you’re to reduce your import costs, we have another article dedicated to duty relief and preferential rating.

How Do I Find My Product’s Commodity Code?

There are two ways to obtain the tariff code for your imports. But before you do so, it’ll pay to be prepared. Make sure you are totally clear on exactly what they are, what they’re made of, how they are packaged, how they work and where they will be used. All this information will be useful in narrowing down the category and finding the correct code.

Let’s take them one at a time:

Using the Online Trade Tariff

Your first stop should be the government’s online Trade Tariff guide. The number of categories and possible codes might seem bewildering at first glance, but the system has been carefully devised to provide an accurate definition of your goods’ exact nature. The list is also designed to be easy to navigate. You can use the site in one of three ways:

1. Search The Tariff

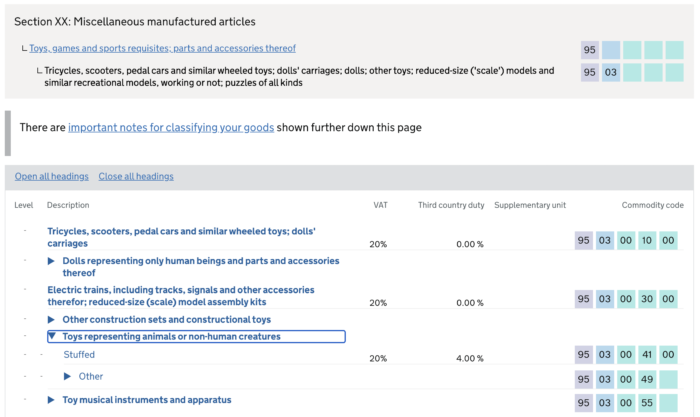

There’s a convenient search box as soon as you land on the site, where you can type in a quick description of your goods. Upon pressing ‘enter’, you’ll find yourself on the appropriate category page where you can refine the exact term for what you’re importing. The level of VAT, duty and the full code are all shown. The screenshot below was from a search for ‘soft toys’:

As it says on the site, if your items are not listed by name, they may be under what they are used for, what they’re made from, or ‘other’. Clicking on the next category (‘stuffed’ above) takes you to full and detailed information for the product(s) under that code.

2. Search A-Z

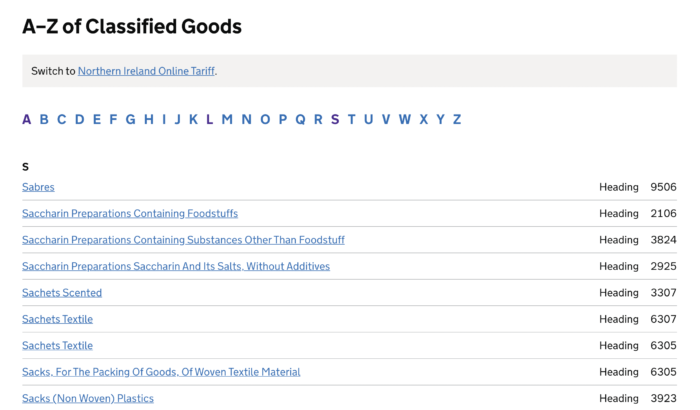

Selecting this option at the top of the first screen will take you to a comprehensive alphabetical list of all categories. It looks like this:

Here, you can scroll through until you find your product, which will usually be listed by name (for example, ‘Soft Toys’ was listed even though it’s not a category title). Clicking on the name will take you to the search result screen as shown above, where you can then refine your category and get the correct code.

3. Search By Section

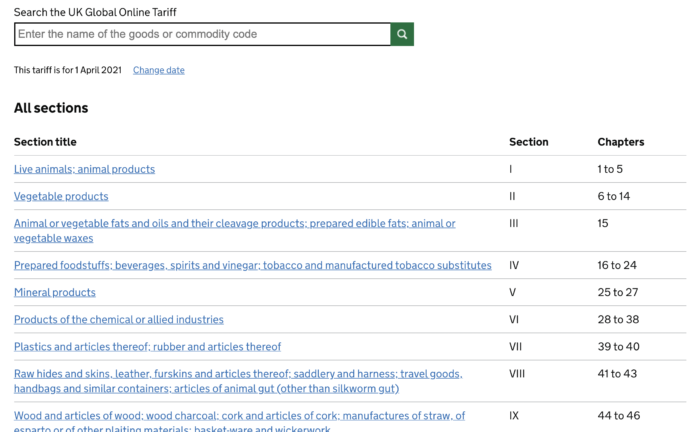

Below the search box on the online Trade Tariff homepage, goods are divided into 21 general main sections. You can start by clicking the one most relevant to you and exploring further within the resulting sub-categories until you find your exact item.

This might look daunting, as there are a lot to go through. However, if you stay focused, it’s easy to narrow down your category to the one you need. Again, you’ll eventually arrive at the results screen as shown earlier.

The site also provides a number of tools to help you find out if your freight is subject to any tariff quotas; what certificates, licenses and documents you might need; additional codes for greater precision on certain items and how to use a CAS number to search the tariff for chemicals.

Emailing HMRC

The online Trade Tariff is your primary source of information for your commodity code. But if it doesn’t give you a clear result, or you have a query, then you’ll need to try the alternative option.

You can email HMRC at classification.enquiries@hmrc.gsi.gov.uk with a complete description of your goods and ask them for their advice.

HMRC have tight criteria for enquiries, and you’ll need to provide comprehensive information in your email, including:

- Your company name, contact name and full contact details

- Which of these options best describes your items: agricultural/chemical/textiles/ceramics or electrical/mechanical/miscellaneous

- What they are made of

- What your products are used for

- How they work or function

- How they are packaged or presented

And, if possible:

- The nearest-fit code you have found, or;

- The partial code for the general section and initial sub-category.

You’ll also need to give more detailed information if your goods are footwear (or parts thereof), food or ingredients, clothing or textiles, or vehicles. A full run-down of exactly what HMRC needs in your email and the process for asking for advice is outlined on the government’s website.

Obtaining An Advanced Tariff Ruling

If you want to be absolutely certain your goods will carry the correct commodity code and pass smoothly through customs when importing into or exporting out of the UK, you can apply for an Advanced Tariff Ruling. This is a legally-binding classification valid throughout the EU for three years.

It’s free to apply for a BTI decision online, but you might have to pay for laboratory testing costs if this is required for classification. You have to do this ahead of any other customs procedures. It’s a three-stage process to apply:

- You’ll need an EORI (Economic Operator Registration & Identification) number that starts with ‘GB’ – if you’ve imported goods before, you’ll probably already have one.

- Make sure you have your Government gateway user ID ready to sign into the gov.uk website.

- Log in and apply for an Advance Tariff Ruling decision.

Alternatively, if you already have your EORI, you can email the Tariff Classification Service at tariff.classification@hmrc.gov.uk with details of what you are importing. You can only apply for one product per online application or email.

HMRC aims to provide a ruling within 120 days. You’ll then be given your correct commodity code and the date from which it will be valid, as well as a unique reference number and an explicit description of your goods.

You can read our guide to EORI numbers for further information.

How Do I Value My Products?

With customs duty being based on the value of your imported goods, it’s important to define how much they are worth. But what is the best way to calculate this?

The government outlines a number of specific methods for certain circumstances, but by far the most common is ‘method 1’. This is relevant for 90% of imports and usually very straightforward.

With method 1, you value your goods according to their ‘transaction value’. This is the price you pay as the buyer to the selling party for the items you are bringing into the UK. This can be subject to a few adjustments – for example, to reflect any additional costs of processing prior to import, engineering fees, commissions, tooling charges, etc. You’ll need to provide copies of all invoices to show the total.

There are eight other methods applicable to different circumstances – for example, if your items are not going to be for sale or are supplied to you without charge. A full run-down of all the rules and ways of valuing your good is available on the HMRC online guide to valuation.

Need Advice on Finding Your Tariff Code?

At HFS, our team is ready to help with all the practicalities around your freight. Customs clearance is naturally part of all our overseas logistics services, and we’re happy to act as your customs agent where required. Please get in touch to discuss your requirements.